Want to Save Money on your Utility Bills?

We have helped our customers recover thousands in overpaid sales tax.

Utility providers are obligated by the state in which they conduct business to collect sales tax on your company’s usage of utilities such as electricity, natural gas, steam, and water. However, utilities (energy) consumed directly in the production or manufacturing processes are possibly exempt from these taxes.

Manufacturers, fabricators, processors and even farming operations facilities will find that a Utility Sales Tax Exemption on the purchase of electricity, natural gas, steam and water can provide one of the largest sources of tax savings.

Our Services:

- Onsite Usage Audit

- Predominant Usage Study

- Communication with state and utility personnel on your behalf

- Required forms and documentation

- Recover up to 4 years of tax overpayments

- Set-up 4-year continuing tax exemption status

- Eliminate your documentation liability

- Appeal any denials

- Ongoing service and annual updates

Are you Eligible?

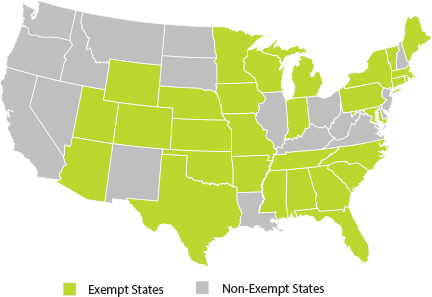

Thirty states currently have tax laws which allow manufacturers, producers and others an exemption or reduction of applicable sales tax on the energy consumed in manufacturing or processing.

We can help you recover the maximum allowable sales tax overpayment and be set up for future savings!

All we would need is a copy of your recent utility bills (perhaps the past 6-12 months) and our team can do a FREE assessment to determine if we can help you.